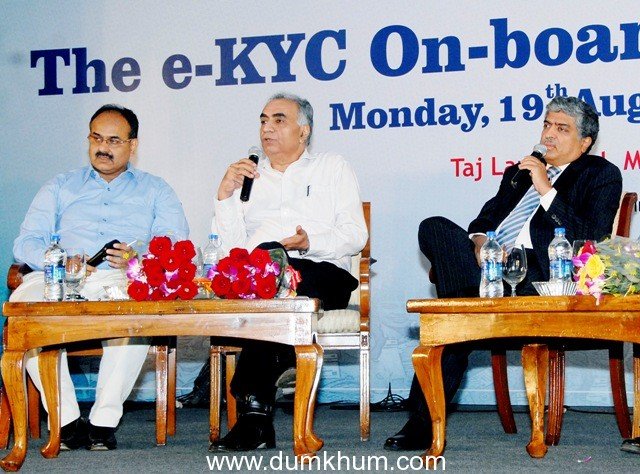

Aadhaar e-KYC – ‘Aadhaar enabled Know Your Customer process (KYC) goes paperless with electronic option.’

As a first of its kind service, the electronic Know Your Customer (e-KYC) service of the Unique Identification Authority of India (UIDAI) is transforming the entire KYC process by making it paperless, instantaneous, secure, economical and nonrepudiable. The UIDAI expects its e-KYC service to enhance customer convenience and greatly increase business efficiency across sectors that require proof of identity and address to open customer accounts. Not only will this service streamline the process of on-boarding new customers but it will also simplify the process of linking existing customer accounts to their respective Aadhaar numbers in an easy yet secure manner.

The Ministry of Finance, Government of India, has already recognized e-KYC as a valid document for all financial services under the Prevention of Money Laundering (PML) Rules. The UIDAI is working with sector regulators for extending e-KYC to their respective sectors.

The e-KYC service will extend the power and convenience of Aadhaar KYC to paperless transactions. Using the e-KYC service, residents can authorize the UIDAI to release their KYC data to a service provider. This authorization can either be done in person (through biometric authentication), or it can be done online (through OTP authentication). Upon successful authentication and consent of the resident, the UIDAI will provide the resident’s name, address, date of birth, gender, photograph, mobile number (if available), and email address (if available) to the service provider electronically.’

Salient features of the Aadhaar e-KYC service

1. Paperless: The service is fully electronic, and document management can be eliminated;

2. Consent based: The KYC data can only be provided upon authorization by the resident through Aadhaar authentication, thus protecting resident privacy;

3. Eliminates Document Forgery: Elimination of photocopies of various documents that are currently stored in premises of various stakeholders reduces the risk of identity fraud and protects resident identity. In addition, since the e-KYC data is provided directly by UIDAI, there is no risk of forged documents;

4. Inclusive: The fully paperless, electronic, low-cost aspects of e-KYC make it more inclusive, enabling financial inclusion;

5. Secure and compliant with the IT Act: Both end-points of the data transfer are secured through the use of encryption and digital signature as per the Information Technology Act, 2000 making e-KYC document legally equivalent to paper documents. In addition, the use of encryption and digital signature ensures that no unauthorized parties in the middle can tamper or steal the data;

6. Non-repudiable: The use of resident authentication for authorization, the affixing of a digital signature by the service provider originating the e-KYC request, and the affixing of a digital signature by UIDAI when providing the e-KYC data makes the entire transaction non-repudiable by all parties involved;

7. Low cost: Elimination of paper verification, movement, and storage reduces the

cost of KYC to a fraction of what it is today;

8. Instantaneous: The service is fully automated, and KYC data is furnished in realtime, without any manual intervention;

9. Machine Readable: Digitally signed electronic KYC data provided by UIDAI is machine readable, making it possible for the service provider to directly store it as the customer record in their database for purposes of service, audit, etc. without human intervention making the process low cost and error free; and

10. Regulation friendly: The service providers can provide a portal to the Ministry/ Regulator for auditing all e-KYC requests. The Ministry/Regulator can establish rules for secure retention of e-KYC data (eg. storage method, period of storage, and retrieval among other things).

Benefits of e-KYC

Resident Benefits

1. The ID document is on person and thus there is no need to carry documents/Cards.

2. No need to leave behind photo copies- possibility of ID theft eliminated.

3. Inclusion through a digital ID for all.

4. Instant gratification – no need to fetch ID documents, immediate on line authentication and service activation.

5. Go Green- no paper, no wastage.

6. Common ID for multiple purposes- government benefits, travel, telecom, LPG and Financial Services.

7. Consent Based release of ID resident in full control of sharing ID.

Benefits to Service providers

1. No paper work- need for photo copy, preservation of physical copy and conversion to digital copy averted.

2. Cost Saving from elimination of collecting and preserving paper copies.

3. Improved Regulatory compliance- back end can monitor KYC fulfilment online.

4. Security enhanced- point to point data transfer from UIDAI server to service

provider server eliminates data and ID theft.

5. Better sales conversion and customer satisfaction through on the spot ID

verification and instant activation of services.

6. Innovation- instant products like ready to use pre-paid cards, on the spot Insurance

Policy and ready to use SIM cards.

Benefits to Regulators

1. Standard KYC – Improved compliance with reduced front end discretion.

2. Real time analytic through Portal based KYC and service monitoring.

3. Expansion of authorised service provider domain supported by discretion free, digital KYC.